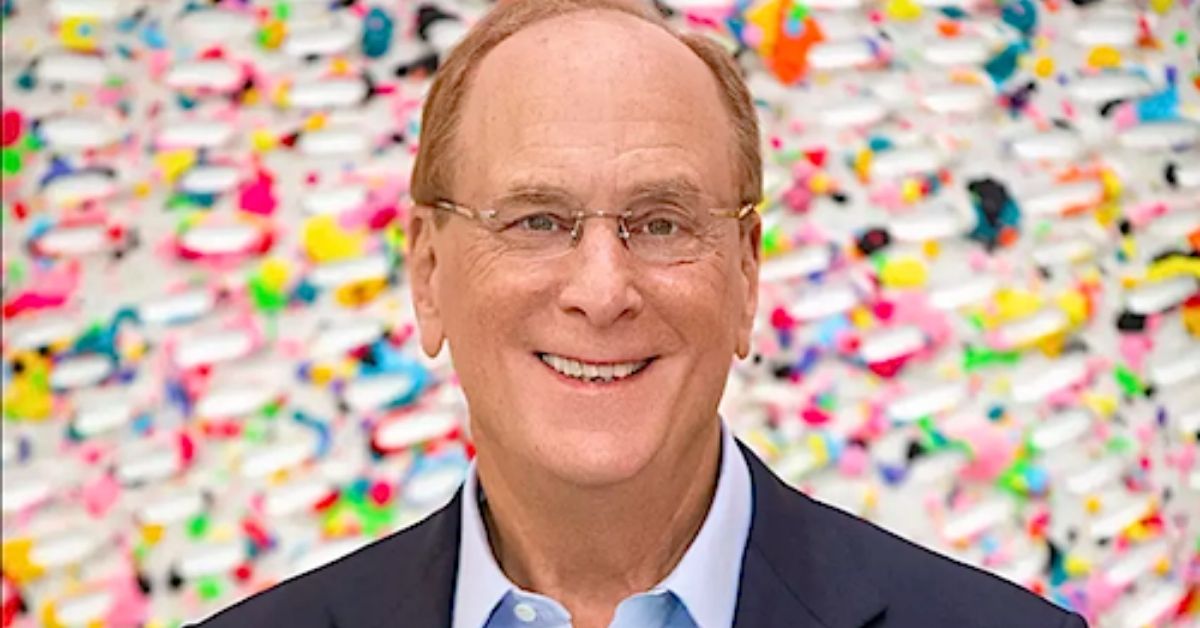

Larry Fink stands as one of the most powerful and respected figures in global finance, known for reshaping modern investment management through disciplined leadership and innovation. As the co-founder and CEO of BlackRock, the world’s largest asset management company, his financial success reflects decades of strategic decision-making, risk management expertise, and long-term vision.

The topic of larry fink net worth goes beyond headline numbers and reveals how equity ownership, executive compensation, and sustained corporate growth combined to build a fortune estimated at $1.3 billion. Understanding his journey offers valuable insight into how influence, governance, and financial strategy intersect at the highest levels of global capital markets.

How Larry Fink’s Net Worth Reached $1.3 Billion

Larry Fink is widely recognized as one of the most influential figures in global finance. As the co-founder and CEO of BlackRock, the world’s largest asset management company, his financial success reflects decades of strategic leadership, innovation, and disciplined execution. This article explores how Larry Fink net worth climbed to an estimated $1.3 billion, examining his career journey, compensation structure, equity holdings, and global influence. From his early life and education to founding BlackRock in 1988, pioneering risk management through the Aladdin system, and steering the firm through multiple financial crises, every stage of his career contributed to his wealth. The article also analyzes his investment philosophy, leadership style, and long-term vision that reshaped modern investment management. By understanding these factors, readers gain insight into how financial leadership, innovation, and governance intersect to create lasting wealth.

Billionaire Status

Larry Fink’s billionaire status is the result of long-term value creation rather than short-term financial wins. His estimated Larry Fink net worth of $1.3 billion places him among the most successful executives in the global investment management industry. Unlike founders who accumulate wealth through a single liquidity event, Fink’s wealth grew steadily through stock ownership, compensation packages, and the expanding market capitalization of BlackRock.

BlackRock’s rise to managing over $10 trillion in assets under management fundamentally changed the scale of asset management companies worldwide. As BlackRock grew, its valuation increased significantly, reaching a $100 billion market cap, which directly amplified the value of Fink’s equity holdings. His wealth is closely tied to the firm’s long-term performance rather than speculative investments.

What distinguishes Fink’s billionaire status is his role as a steward of institutional capital. BlackRock serves pension funds, sovereign wealth funds, insurance companies, and institutional clients that require stability and risk control. This trust-driven model produced consistent revenue streams through management fees and advisory services, ensuring steady growth. Over decades, this compounding effect transformed professional leadership into substantial personal wealth, solidifying Larry Fink’s position as a finance billionaire rooted in operational excellence.

Salary

Larry Fink’s annual compensation reflects his responsibilities as CEO of the world’s largest asset management company. His $36 million (2022 earnings) package included base salary, bonuses, and long-term incentives tied to BlackRock’s performance. While this figure is substantial, it represents only a fraction of his total wealth, which is primarily derived from stock ownership and equity appreciation.

His compensation package is structured to align leadership decisions with shareholder value. Performance-based incentives encourage long-term thinking rather than short-term profit maximization. This structure is common among executives leading firms with large institutional clients, where stability and governance matter more than aggressive risk-taking.

Fink’s salary must also be viewed in the context of BlackRock’s scale. With more than $20 billion in revenue, his compensation represents a small percentage of the company’s overall earnings. Compared to peers in global finance, his pay is competitive but not excessive relative to the firm’s size and influence.

Importantly, Fink has consistently emphasized that leadership compensation should be tied to sustainable performance. This philosophy reinforces trust among investors and strengthens corporate governance, further supporting BlackRock’s long-term valuation and, indirectly, Larry Fink’s wealth.

Personal Life

Despite his immense wealth and influence, Larry Fink maintains a relatively private personal life. Born on November 2, 1952, in Los Angeles, California, he grew up in a middle-class family in Van Nuys, California. His upbringing emphasized discipline, education, and responsibility—values that later shaped his leadership style.

Fink is married and has children, and he is known for prioritizing family alongside professional commitments. Unlike many high-profile billionaires, he avoids public displays of luxury and maintains a reserved lifestyle. This low-profile approach aligns with his professional image as a steady, disciplined financial executive.

His personal values also influence his professional decisions. Fink frequently speaks about long-term responsibility, stakeholder capitalism, and sustainable investing. These principles are not just corporate strategies but reflections of his broader worldview.

Philanthropy and education are areas of interest for Fink, particularly initiatives that support financial literacy and economic stability. While he does not seek public attention for charitable efforts, his influence extends beyond finance into shaping discussions around corporate responsibility and societal impact.

Early Life and Education

Larry Fink’s path to financial leadership began with a strong academic foundation. He attended the University of California, Los Angeles (UCLA), where he earned a bachelor’s degree in political science. Recognizing the importance of advanced business knowledge, he later completed his MBA at UCLA, specializing in real estate and finance.

This educational background provided him with both analytical and strategic perspectives. At UCLA, Fink developed a strong understanding of economic systems, risk analysis, and institutional decision-making. These skills became critical throughout his career, especially in fixed-income markets and investment management.

After completing his MBA, Fink joined First Boston, a major investment bank where he specialized in fixed-income trading. His early success was notable, but so was a significant trading loss that reshaped his thinking about risk management. Rather than derailing his career, this experience became a turning point.

The lesson he took from that setback was clear: risk must be measured, managed, and integrated into every investment decision. This insight later became the foundation for BlackRock’s approach to investment management and played a crucial role in building Larry Fink’s long-term wealth.

Founding BlackRock

In 1988, Larry Fink co-founded BlackRock with a clear vision: to create an asset management company centered on disciplined risk management. Starting with a modest team, BlackRock initially focused on fixed-income investments for institutional clients, including pension funds and insurance companies.

The firm’s early success stemmed from its ability to provide transparency and control in complex financial markets. Unlike competitors chasing aggressive returns, BlackRock emphasized consistent performance and risk-adjusted outcomes. This approach attracted large institutional investors seeking reliability.

BlackRock’s growth accelerated through strategic decisions, including its IPO (initial public offering), which raised $375 million. Going public allowed the company to scale operations, invest in technology, and expand globally. For Fink, this milestone significantly increased his stock ownership value.

As BlackRock evolved into a global asset management powerhouse, its founding principles remained intact. Fink’s leadership ensured that the firm balanced innovation with prudence. This balance not only built trust with clients but also laid the groundwork for sustained wealth creation, directly contributing to Larry Fink’s net worth.

Pioneering Risk Management

One of Larry Fink’s most significant contributions to finance is his role in pioneering modern risk management. At the core of this innovation is the Aladdin system, a proprietary platform that integrates risk analytics, portfolio management, and trading functions.

Aladdin transformed how asset management companies evaluate risk across multiple asset classes. It allows BlackRock and its clients to analyze market exposures, stress-test portfolios, and make data-driven decisions. Today, Aladdin is used not only internally but also by external institutional clients, generating additional revenue streams.

This focus on risk management differentiated BlackRock from competitors, particularly during periods of market volatility. The system proved invaluable during financial crises, reinforcing BlackRock’s reputation as a stable and reliable investment manager.

For Larry Fink, Aladdin represents more than technology—it embodies his philosophy that understanding risk is essential to long-term success. This innovation strengthened BlackRock’s market position, increased assets under management, and enhanced profitability, all of which contributed significantly to Fink’s growing wealth and influence.

Revenue and Compensation

BlackRock’s financial success provides the foundation for Larry Fink’s compensation and wealth accumulation. With annual revenue exceeding $20 billion, the firm benefits from diversified income sources, including management fees, advisory services, and technology solutions like Aladdin.

The firm’s scale allows it to generate stable cash flows even during market downturns. Management fees tied to assets under management ensure recurring income, while advisory services support governments and institutions during complex financial transitions.

Fink’s compensation package is closely linked to these revenue streams. Long-term incentives reward sustained performance rather than short-term gains. This alignment reinforces responsible decision-making at the executive level.

As BlackRock’s revenue grows, so does its ability to reinvest in technology, acquisitions, and global expansion. These investments increase shareholder value, benefiting Fink through equity appreciation. Over time, this model transformed operational success into personal financial growth, reinforcing Larry Fink’s status as one of the wealthiest executives in finance.

Strategic Acquisitions

Strategic acquisitions played a critical role in expanding BlackRock’s capabilities and market reach. One of the most significant moves was the acquisition of Barclays Global Investors for $13.5 billion, which included the iShares platform.

This acquisition positioned BlackRock as the global leader in ETF (exchange-traded funds). iShares expanded the firm’s product offerings and attracted a new segment of investors seeking low-cost, diversified investment solutions.

The integration of Barclays Global Investors significantly increased BlackRock’s assets under management and strengthened its competitive advantage. ETFs became a major growth driver, contributing to revenue diversification and scalability.

These strategic acquisitions were not opportunistic but carefully aligned with long-term trends in investment management. By anticipating shifts toward passive investing, Fink ensured BlackRock remained ahead of the curve. The resulting growth in market capitalization directly enhanced his equity holdings and overall wealth.

Leadership During Crises

Larry Fink’s leadership was most visible during periods of global financial stress. During the financial crisis, BlackRock was called upon to advise governments and central banks on managing distressed assets and stabilizing markets.

This role reinforced BlackRock’s credibility and expanded its global influence. Fink’s calm, data-driven approach helped institutions navigate uncertainty, further strengthening trust in the firm’s expertise.

Rather than retreating during crises, BlackRock expanded its advisory services and risk management offerings. This countercyclical strategy allowed the company to grow even as markets struggled.

Fink’s ability to lead during crises enhanced his reputation as a thought leader and responsible steward of capital. These moments of leadership not only protected BlackRock’s business but also accelerated its growth, contributing to long-term wealth creation and reinforcing Larry Fink’s financial legacy.

Equity Holdings

A substantial portion of Larry Fink’s wealth comes from his equity holdings in BlackRock. His stock ownership aligns his financial interests with those of shareholders, reinforcing accountability and long-term focus.

As BlackRock’s market capitalization grew to $100 billion, the value of Fink’s shares increased accordingly. Unlike cash-based compensation, equity holdings benefit from compounding growth over time.

These holdings also provide Fink with influence over corporate governance and strategic direction. His ownership stake underscores his commitment to the firm’s success and stability.

Equity-based wealth accumulation reflects Fink’s belief in long-term value creation. Rather than diversifying away from his core business, he remained invested in BlackRock, demonstrating confidence in its future. This approach has been central to building Larry Fink’s net worth.

Global Influence

Larry Fink’s influence extends far beyond financial metrics. As CEO of BlackRock, he is a prominent thought leader in global finance, known for his annual letters to CEOs that address corporate governance, sustainability, and long-term strategy.

These letters shape conversations around ESG investing, Environmental, Social, and Governance principles, and stakeholder capitalism. Fink advocates for sustainable investing and long-term sustainability, arguing that responsible practices enhance long-term financial performance.

His perspectives influence corporate boards, policymakers, and institutional investors worldwide. BlackRock’s voting power as a major shareholder further amplifies this influence.

This global reach enhances BlackRock’s brand and reinforces its leadership position. For Fink, influence translates into trust, and trust drives capital flows. This dynamic strengthens the firm’s financial foundation and supports continued growth in his personal wealth.

End Note

Larry Fink’s journey to an estimated $1.3 billion net worth is a case study in disciplined leadership, innovation, and long-term thinking. From founding BlackRock in 1988 to pioneering risk management and guiding the firm through global crises, every step reinforced sustainable growth.

His wealth reflects not just personal success but the value created for institutional clients, shareholders, and the broader financial system. By prioritizing risk management, strategic acquisitions, and responsible governance, Fink reshaped modern investment management.

Ultimately, Larry Fink’s story demonstrates that enduring wealth is built through vision, accountability, and commitment to long-term value—principles that continue to define his legacy in global finance.

Smith Patel is a blessing-focused writer with 4+ years of hands-on experience creating meaningful and personalized blessings. He specializes in spiritual expression that promotes positivity, emotional clarity, and personal growth.Smith’s work blends compassion, creativity, and a deep understanding of human connection to help readers find peace and purpose in everyday moments.